Are there any legal implications associated with intercompany agreements? As more businesses engage in intercompany transactions, it is essential to understand the potential legal ramifications that could arise. Intercompany agreements are contracts entered into between two or more entities within the same corporate group, addressing various aspects of their relationship, such as the supply of goods or services, financial arrangements, or intellectual property rights.

Intercompany agreements play a vital role in defining the terms and conditions under which transactions occur within a corporate group. However, these agreements also carry legal implications that businesses must be aware of. Failure to comply with applicable laws and regulations can result in serious consequences for the involved parties, ranging from financial penalties to legal disputes. Moreover, non-compliance may also affect the tax treatment of intercompany transactions, creating additional complications.

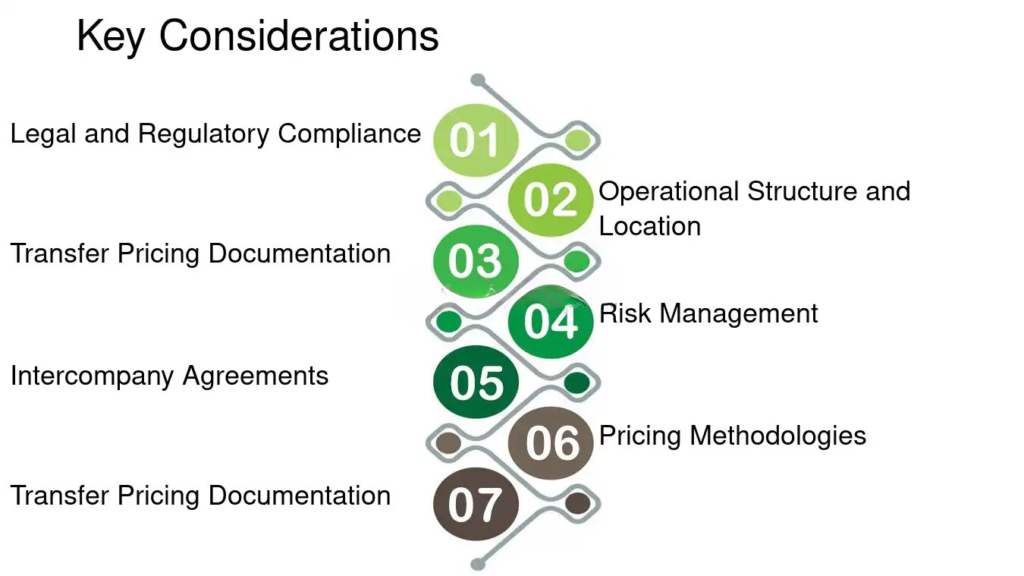

To understand the legal implications associated with intercompany agreements, it is crucial to examine the key considerations that companies need to be aware of. By gaining a deeper understanding of the legal landscape surrounding intercompany agreements, companies can ensure compliance and mitigate any risks that may arise.

Intercompany agreements can give rise to several legal issues that companies should be mindful of. One common issue is the potential for conflicts of interest between different entities within the corporate group. These conflicts can arise when one entity receives preferential treatment or engages in transactions that are not at arm’s length. Such conflicts can lead to legal disputes and damage the relationships within the corporate group.

Another legal issue that may arise is the violation of competition laws. Intercompany agreements should not contain provisions that restrict competition or engage in anti-competitive behavior. Companies must ensure that their agreements comply with competition laws to avoid legal scrutiny and potential penalties.

Additionally, intercompany agreements may involve the transfer of intellectual property rights. Ensuring proper protection and licensing of intellectual property is crucial to avoid infringement and potential legal disputes. Companies must carefully draft agreements that clearly define the scope of intellectual property rights and any restrictions or licensing arrangements.

Proper documentation is crucial when it comes to intercompany agreements. Clear and well-drafted agreements can help prevent misunderstandings, provide evidence of the parties’ intentions, and ensure compliance with legal requirements. By investing time and effort into drafting comprehensive and precise agreements, companies can avoid legal disputes and protect their interests.

When drafting intercompany agreements, it is essential to clearly define the rights and obligations of each party involved. This includes specifying the scope of goods or services to be provided, the pricing and payment terms, and any intellectual property rights involved. Additionally, agreements should address dispute resolution mechanisms, confidentiality provisions, and termination clauses.

Proper documentation also extends to maintaining accurate records of intercompany transactions. Companies should keep detailed records of their transactions to demonstrate compliance with transfer pricing regulations and tax obligations. This documentation can be invaluable in the event of a tax audit or legal dispute.

To ensure legal compliance and mitigate risks, intercompany agreements should include several key provisions. These provisions can vary depending on the nature of the transactions and the corporate group’s specific circumstances. However, some common provisions that should be considered include:

. Definitions And Interpretations: Clearly defining key terms and concepts used within the agreement can help avoid ambiguity and misunderstandings.

Rights And Obligations: Outlining the rights and obligations of each party involved will help establish clarity and avoid potential disputes.

Pricing And Payment Terms: Clearly specifying the pricing and payment terms for goods or services provided will ensure transparency and prevent potential issues related to transfer pricing.

Intellectual Property Rights: If the agreement involves the transfer of intellectual property, clearly defining the scope of the rights, any licensing arrangements, and any restrictions is essential.

Confidentiality Provisions: Including confidentiality provisions can protect sensitive information shared between the parties and prevent unauthorized disclosure.

Dispute Resolution Mechanisms: Specifying the methods for resolving disputes, such as through negotiation, mediation, or arbitration, can help prevent costly and time-consuming legal proceedings.

Termination clauses: Including termination clauses that outline the circumstances under which the agreement can be terminated can provide clarity and protect the parties’ interests.

Compliance with applicable laws and regulations is of utmost importance when it comes to intercompany agreements. Failure to comply can result in severe legal and financial consequences. Here are some compliance considerations that companies should keep in mind:

Transfer Pricing Regulations: Intercompany transactions must comply with transfer pricing regulations, which ensure that transactions between related entities are conducted at arm’s length. Failure to comply with these regulations can lead to tax adjustments and penalties.

Competition Laws: Intercompany agreements should not contain provisions that restrict competition or engage in anti-competitive behavior. Companies must ensure that their agreements comply with competition laws to avoid legal scrutiny and potential penalties.

Tax Implications: Intercompany agreements can have significant tax implications. Companies must carefully consider the tax treatment of their transactions and ensure compliance with applicable tax laws.

Corporate Governance: Intercompany agreements should align with the corporate governance framework of the corporate group. Companies must ensure that the agreements are in line with their internal policies and procedures.

Data Protection: If intercompany agreements involve the transfer of personal data, companies must comply with relevant data protection laws. This includes obtaining necessary consents and implementing appropriate security measures.

By proactively addressing these compliance considerations, companies can minimize potential legal risks and ensure the smooth operation of their intercompany transactions.

To mitigate legal risks associated with intercompany agreements, companies should adopt certain best practices. These practices can help ensure legal compliance and protect the interests of all parties involved. Some key best practices include:

Thorough Review: Conduct a thorough review of the agreement to identify any potential legal risks or compliance issues. This may involve consulting legal professionals who specialize in intercompany agreements.

Clear Communication: Maintain open and clear lines of communication between the entities within the corporate group. This will help ensure that all parties are aware of the terms and conditions of the intercompany agreements and can raise any concerns or questions.

Regular Updates: Keep intercompany agreements up to date with any changes in laws, regulations, or internal policies. Regularly reviewing and updating agreements will help ensure ongoing legal compliance.

Internal Controls: Implement robust internal controls and processes to monitor and manage intercompany transactions. This includes maintaining accurate records, conducting periodic audits, and ensuring compliance with transfer pricing regulations.

Training And Education: Provide training and education to employees involved in intercompany transactions. This will help raise awareness of legal requirements and ensure that all parties are equipped to comply with relevant laws and regulations.

Reviewing and negotiating intercompany agreements require careful attention to detail and an understanding of legal considerations. Here are some best practices to follow during the review and negotiation process:

Engage Legal Professionals: Seek the expertise of legal professionals who specialize in intercompany agreements. They can provide valuable insights and ensure that the agreement is legally sound.

Thoroughly Understand The Agreement: Take the time to thoroughly understand the terms and conditions of the agreement. This includes reviewing all provisions, definitions, and obligations.

Identify Potential Risks: Analyze the agreement to identify any potential legal risks or compliance issues. This includes assessing the agreement against applicable laws, regulations, and internal policies.

. Negotiate Favorable Terms: During the negotiation process, ensure that the agreement protects the interests of all parties involved. This may involve discussing and clarifying ambiguous or unclear provisions.

. Document Negotiations: Keep a record of all negotiations and any changes made to the agreement. This documentation can be useful in the event of a dispute or for future reference.

Given the complexity and potential legal implications of intercompany agreements, it is advisable to consult legal professionals with expertise in this area. Legal professionals can provide valuable guidance and ensure that the agreements are legally compliant, protecting the interests of the corporate group.

When engaging legal professionals, it is essential to choose individuals or firms with experience in intercompany agreements. They should have a deep understanding of the relevant laws and regulations, as well as the specific industry in which the corporate group operates.

By working closely with legal professionals, companies can navigate the complex legal landscape surrounding intercompany agreements with confidence and ensure legal compliance.

Intercompany agreements are essential for defining the terms and conditions of transactions within a corporate group. However, they also carry legal implications that companies must be aware of. Compliance with legal requirements is crucial to avoid financial penalties, legal disputes, and adverse tax implications.

By understanding the legal landscape surrounding intercompany agreements, businesses can ensure compliance and mitigate any risks that may arise. Proper documentation, including clear agreements and accurate records, is essential. Key provisions such as definitions, rights and obligations, pricing and payment terms, intellectual property rights, and dispute resolution mechanisms should be included. Compliance considerations, such as transfer pricing regulations, competition laws, tax implications, corporate governance, and data protection, must also be addressed.

Mitigating legal risks requires adopting best practices, including thorough review and regular updates of agreements, robust internal controls, employee training, and engaging legal professionals. Consulting with legal professionals who specialize in intercompany agreements can provide valuable insights and ensure legal compliance.

By following these guidelines and best practices, companies can navigate the legal implications of intercompany agreements effectively and protect their interests within the corporate group.

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!