Did you know that 67% of international businesses waste thousands of euros yearly by misunderstanding German tax requirements for their office setup?

A virtual office in Germany offers you the perfect balance between maintaining a professional business presence and managing your tax obligations efficiently. House of Companies provides virtual office services that meet all German tax authority requirements while helping you establish your statutory address in Germany.

This comprehensive guide examines the tax implications of using a virtual office in Germany, from registration requirements to compliance standards. You’ll learn about essential documentation, physical presence expectations, and industry-specific considerations that affect your tax position. Whether you’re a service provider, retailer, or manufacturer, understanding these tax requirements will help you make informed decisions about your German business presence.

Setting up your business presence in Germany requires careful attention to tax authority requirements. House of Companies ensures your virtual office meets all legal and tax compliance standards right from day one.

Your virtual office in Germany is completely legal and accepted by tax authorities, provided it meets specific criteria. The German tax office (Finanzamt) evaluates virtual addresses based on your business type and operational needs. For online businesses and digital services, you’ll find virtual offices are readily accepted. However, your virtual address must guarantee reliable accessibility for tax communications and official documents.

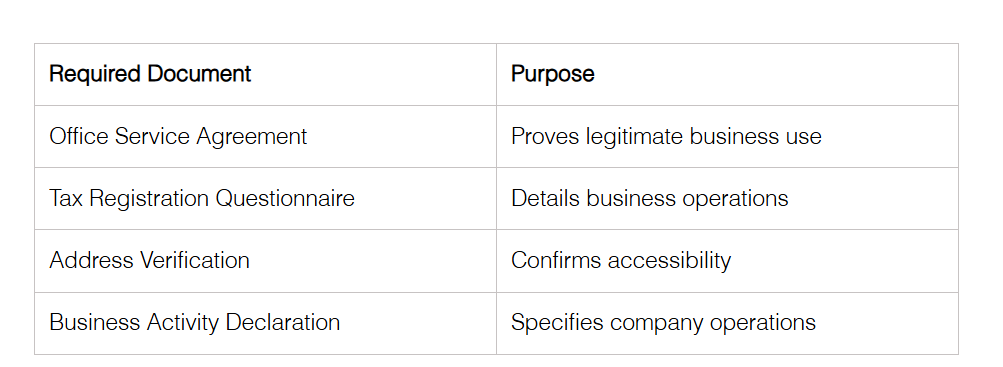

To establish your tax-compliant virtual office, you’ll need:

House of Companies handles all documentation requirements, ensuring your virtual office registration proceeds smoothly with German tax authorities.

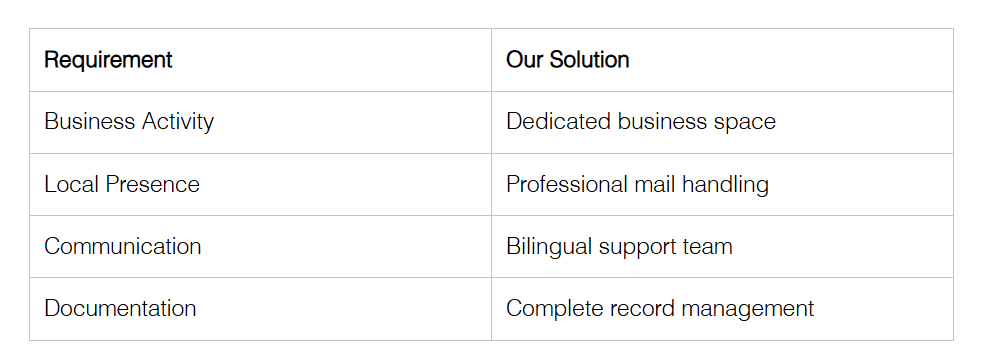

While maintaining a virtual office, you should understand that German tax authorities have specific expectations regarding physical presence:

Important: When completing your tax registration questionnaire, you should list your virtual business address as the company address and your home location as the place of business management. This distinction is crucial for tax compliance and helps avoid unnecessary on-site inspections.

House of Companies provides you with essential features that satisfy these requirements, including a dedicated letterbox, visible company signage in the building foyer, and access to professional meeting spaces when needed. Your virtual office through House of Companies meets all tax office regulations while offering the flexibility your business needs.

Transform your German business registration into a seamless experience with House of Companies’ comprehensive virtual office solutions. Our expert team handles every aspect of your tax registration process, ensuring 100% compliance with German regulations.

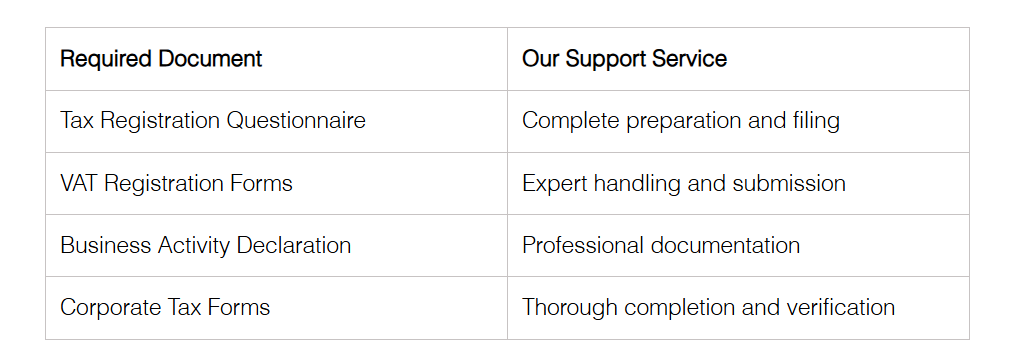

Your tax registration journey starts with essential documentation through the ELSTER system. House of Companies assists you with:

House of Companies makes your address verification process effortless and reliable. Your statutory address in Germany comes with:

Professional mail handling and scanning

Dedicated business address verification

Real-time documentation updates

Direct communication with tax authorities

We ensure your virtual office in Germany meets all verification requirements, maintaining your business’s credibility with German tax authorities.

Experience shows that businesses often face specific hurdles during tax registration. House of Companies helps you overcome these challenges:

Address Acceptance: Some tax offices question virtual addresses. Our service includes comprehensive documentation proving your address legitimacy.

Documentation Complexity: The German tax system requires numerous forms and declarations. Our experts handle all paperwork, ensuring accurate completion and timely submission.

VAT Registration: International businesses often struggle with VAT registration procedures. House of Companies manages the entire process, from initial application to final approval.

Communication Barriers: Language differences can complicate tax registration. Our bilingual team handles all communication with German authorities on your behalf.

Your statutory address through House of Companies comes with built-in solutions to these common challenges. We’ve successfully helped hundreds of businesses establish their presence in Germany, making us your ideal partner for smooth tax registration.

Make your virtual office in Germany fully compliant with House of Companies’ comprehensive compliance package. Our expert team ensures your business meets every tax requirement while maximizing operational efficiency.

Your virtual office must demonstrate real business substance. House of Companies delivers a complete solution:

Boost your business credibility with our premium virtual office services that exceed standard substance requirements.

House of Companies makes German tax compliance simple with our advanced record-keeping system:

Digital document management following GoBD standards

Real-time transaction recording within 10 days

Secure cloud-based storage meeting German regulations

Complete audit trail maintenance

Daily recording of cash transactions

Your statutory address in Germany comes with built-in compliance tools that keep your records perfect and audit-ready.

Turn tax audits from stress into success with House of Companies’ comprehensive audit support:

Pre-Audit Excellence:

Get ready for German tax audits with our complete preparation service. House of Companies provides:

– Professional document organization

– Systematic record verification

– Expert compliance checks

– Real-time access to required information

During Audit Support:

Your virtual office package includes full audit assistance:

– Dedicated audit response team

– Immediate document retrieval

– Professional representation

– Clear communication channels

House of Companies transforms your local address in Germany into a compliance powerhouse. Our virtual offices services go beyond basic requirements, delivering complete peace of mind for your German business operations. With our expert team handling your compliance needs, you can focus on growing your business while we manage the complex world of German tax regulations.

Your industry demands specialized tax handling, and House of Companies delivers exactly what you need. Our virtual office services in Germany come with industry-specific tax solutions that put you ahead of the competition.

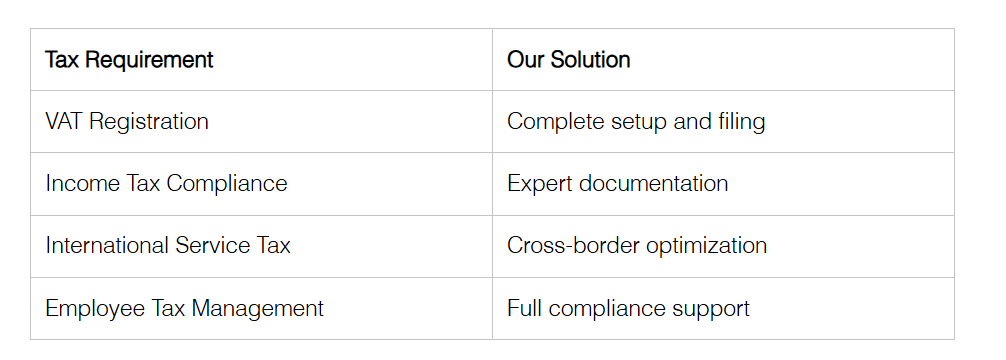

House of Companies makes your service business tax-efficient with our premium virtual office package:

Boost your service business with our dedicated virtual office solutions that handle every tax detail perfectly.

Transform your online business with our e-commerce-ready virtual office in Germany. Starting 2023, the Platform Tax Transparency Act brings new requirements:

Mandatory data collection and reporting

Enhanced transaction documentation

Cross-border sales monitoring

Platform operator obligations

House of Companies gives you a complete e-commerce tax package that covers everything from VAT registration to platform compliance. Your statutory address in Germany comes with built-in solutions for all Platform Tax Transparency Act requirements.

Make your manufacturing operations tax-efficient with House of Companies’ specialized virtual office solutions. We understand the unique challenges of manufacturing businesses:

Inventory Management:

Your manufacturing business gets expert support for:

– LIFO/FIFO optimization

– Just-in-time inventory tax implications

– Stock valuation compliance

– Supply chain tax efficiency

International Operations:

House of Companies powers your cross-border success with:

– Transfer pricing documentation

– Double taxation prevention

– Supply chain tax optimization

– International compliance management

Your local address in Germany through House of Companies includes complete support for manufacturing-specific tax requirements. We handle everything from inventory valuation to international tax treaties, letting you focus on production excellence.

House of Companies transforms complex industry requirements into simple solutions. Our virtual offices services include specialized tax support packages designed for your specific industry needs. Whether you’re in services, retail, or manufacturing, your German business gets exactly the tax support it needs to thrive.

Protect your business from tax risks with House of Companies’ advanced virtual office solutions in Germany. Our comprehensive risk management package transforms complex tax challenges into worry-free operations.

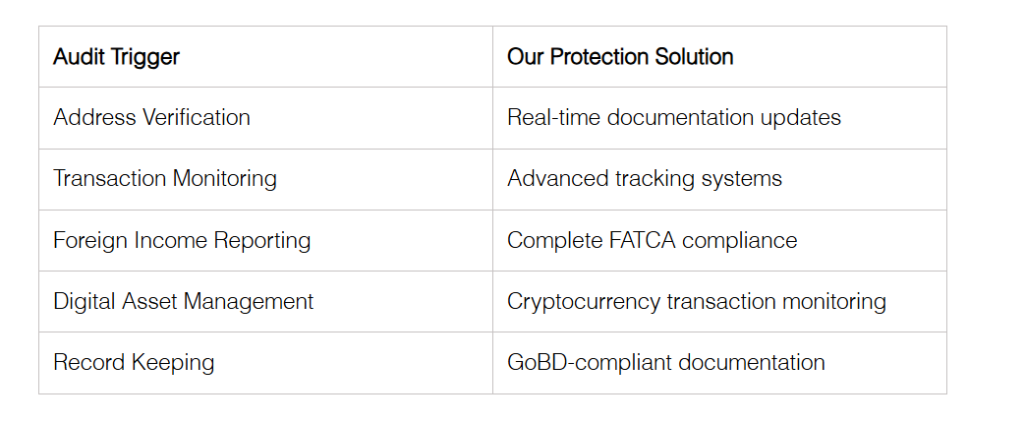

House of Companies helps you stay ahead of common audit triggers that affect virtual offices in Germany:

Your virtual office in Germany comes with built-in protection against these triggers. House of Companies’ expert team constantly monitors your business activities to ensure full compliance with German tax regulations.

Transform your tax risk management with House of Companies’ premium virtual office services. Our comprehensive approach includes:

Real-time Compliance Updates: Your statutory address in Germany includes immediate notifications about regulatory changes

Expert Documentation Management: Professional handling of all tax-related paperwork

Advanced Data Analytics: Continuous monitoring of your business transactions

Multi-jurisdictional Support: Complete assistance for cross-border operations

Audit Defense Preparation: Regular health checks and documentation reviews

House of Companies delivers more than just a local address in Germany – we provide complete peace of mind with our risk mitigation solutions.

Experience next-level tax compliance with our state-of-the-art monitoring systems. Your virtual offices services package includes:

Technology-Driven Solutions:

House of Companies employs advanced monitoring tools that ensure your business stays compliant:

– Automated transaction tracking

– Real-time compliance alerts

– Digital document management

– Instant report generation

– Comprehensive audit trails

Expert Support Systems:

Your business benefits from our dedicated compliance team:

– Regular compliance reviews

– Proactive risk assessments

– Expert consultation services

– Immediate issue resolution

– Continuous monitoring updates

House of Companies transforms your tax compliance from a challenge into a competitive advantage. Our virtual office in Germany includes comprehensive monitoring systems that protect your business around the clock.

Enhanced Protection Features:

Your statutory address in Germany comes with additional safeguards:

– Daily transaction monitoring

– Automated compliance checks

– Regular health assessments

– Risk alert systems

– Expert guidance

House of Companies ensures your virtual office operations maintain the highest compliance standards. Our dedicated team works continuously to protect your business from potential tax risks while maximizing operational efficiency.

Strategic Advantages:

Choose House of Companies for unmatched benefits:

– Reduced audit risks

– Enhanced compliance efficiency

– Cost-effective risk management

– Professional representation

– Complete peace of mind

Your local address in Germany through House of Companies includes everything needed for robust tax risk management. We handle the complexities while you focus on growing your business.

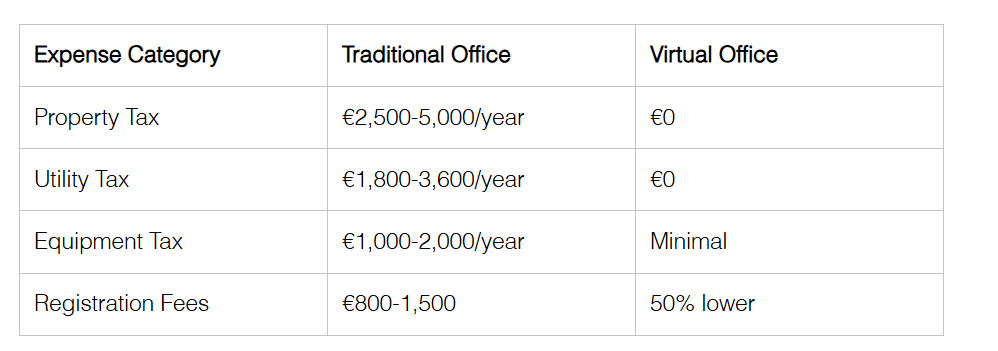

Smart businesses save up to 30% on operational costs with a virtual office in Germany. House of Companies delivers premium virtual office solutions that maximize your tax benefits while minimizing expenses.

Your virtual office in Germany through House of Companies brings substantial tax advantages:

House of Companies transforms your business expenses into tax advantages. Your statutory address in Germany includes complete tax optimization features that traditional offices simply cannot match.

House of Companies’ virtual offices services create lasting financial benefits:

Direct Tax Benefits:

€1,230 annual home office deduction allowance

Up to 30% savings on operational costs

Full deduction of virtual office expenses

Zero property tax obligations

Reduced VAT implications

Your local address in Germany through House of Companies opens doors to substantial government incentives. The German tax system offers numerous benefits for businesses using virtual offices, including research and development funding, tax reliefs, and special subsidies.

Business Growth Advantages:

House of Companies helps you reinvest tax savings into growth:

– Zero security deposit requirements

– Flexible monthly payments

– Pay-as-you-use additional services

– Scalable service packages

– Premium address benefits

Make informed decisions about your virtual office in Germany with complete cost transparency from House of Companies:

Standard Compliance Costs:

Your virtual office package includes protection from unexpected expenses:

– Registration fee coverage

– Document processing charges

– Address verification costs

– Mail handling expenses

– Communication fees

Advanced Protection Features:

House of Companies shields you from hidden costs through:

1. Comprehensive Compliance Package:

– Complete tax registration support

– Full documentation management

– Expert consultation services

– Regular compliance updates

2. Cost Control Systems:

– Fixed monthly fees

– Transparent pricing

– No hidden charges

– Clear service agreements

Tax Optimization Benefits:

Your statutory address in Germany includes built-in savings:

– Double taxation prevention

– Cross-border tax efficiency

– VAT optimization

– Audit defense preparation

House of Companies delivers more than just cost savings – we provide complete financial optimization for your German business presence. Your virtual office package includes everything needed for tax-efficient operations:

Premium Features:

– Professional business address

– Complete mail management

– Tax compliance support

– Document handling services

– Meeting room access

Financial Advantages:

– Reduced operational costs

– Lower tax obligations

– Minimal startup expenses

– Flexible payment terms

– Scalable services

Your local address in Germany through House of Companies comes with built-in financial benefits that grow with your business. We handle every detail of your tax optimization strategy:

Strategic Benefits:

– Complete cost transparency

– Expert tax guidance

– Full compliance support

– Premium location advantages

– Professional business image

House of Companies transforms your virtual office investment into lasting financial success. Our comprehensive packages include:

– Premium address services

– Complete tax optimization

– Expert compliance support

– Professional mail handling

– Meeting facility access

Your virtual office in Germany becomes a powerful tool for financial success with House of Companies. We deliver complete solutions that maximize your tax benefits while minimizing operational costs:

Service Excellence:

– Premium business address

– Expert tax guidance

– Complete compliance support

– Professional representation

– Growth-focused solutions

House of Companies makes your virtual office investment work harder for your business. Our premium services include everything needed for tax-efficient operations in Germany:

– Complete cost transparency

– Expert financial guidance

– Full compliance support

– Premium location benefits

– Professional business presence

Virtual offices through House of Companies offer you a smart, tax-efficient way to establish your business presence in Germany. This comprehensive solution addresses every aspect of German tax compliance while reducing your operational costs by up to 30%.

Your virtual office package delivers essential benefits:

– Complete tax registration and compliance support

– Professional address verification and documentation

– Industry-specific tax solutions

– Advanced risk management systems

– Substantial cost savings compared to traditional offices

House of Companies stands out as your reliable partner for German business operations. Our expert team handles complex tax requirements, maintains perfect documentation, and protects you from compliance risks. Your business gets premium services that satisfy German tax authorities while supporting your growth plans.

German tax regulations demand attention to detail and thorough compliance. House of Companies transforms these requirements into opportunities for your business, providing expert support that goes beyond basic virtual office services. Your statutory address comes with built-in solutions for every tax challenge, letting you focus on business growth while we manage the complexities of German regulations.

Virtual offices in Germany must meet specific criteria set by the tax authorities, including reliable accessibility for official communications, proper documentation for tax registration, and adherence to physical presence expectations. Businesses need to provide an office service agreement, tax registration questionnaire, address verification, and a business activity declaration.

Tax registration with a virtual office involves submitting required forms and declarations through the ELSTER system, including a tax registration questionnaire, VAT registration forms, and corporate tax forms. The process also includes address verification procedures to prove the legitimacy of the virtual office address.

Businesses must maintain digital document management following GoBD standards, record transactions within 10 days, use secure cloud-based storage meeting German regulations, maintain a complete audit trail, and record cash transactions daily. These practices ensure compliance with German tax regulations.

Yes, different industries have specific tax requirements. For example, e-commerce businesses must comply with the Platform Tax Transparency Act, which includes mandatory data collection and reporting. Manufacturing businesses need to consider inventory management tax implications and international operations requirements.

Tax risk management involves staying aware of potential audit triggers, implementing risk mitigation strategies, and using compliance monitoring systems. This includes real-time compliance updates, expert documentation management, advanced data analytics, and regular compliance reviews to ensure adherence to German tax regulations.

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!