Are you aware of the different tax brackets in Germany and how they could impact your tax liability? Understanding the tax system in any country is vital, especially for expats or individuals planning to move to Germany. In this article, we will delve into the various tax brackets in Germany and explain how they can affect your financial situation.

Germany operates on a progressive tax system, wherein the tax rate increases as your income rises. Knowing which tax bracket you fall into is crucial for calculating your tax liability accurately. We will discuss the different tax brackets and their corresponding income thresholds, as well as the applicable tax rates.

By understanding the tax brackets in Germany, you can make informed financial decisions and plan your taxes effectively. Whether you are an employee, entrepreneur, or self-employed professional, the information provided here will help you navigate the German tax system with ease.

Stay tuned to gain valuable insights into the tax brackets in Germany and learn how they could impact your tax liability.

Germany has a comprehensive income tax system that applies to residents, non-residents, and individuals with various types of income. Before we dive into the different tax brackets, let’s understand the basics of income tax in Germany.

In Germany, the tax year runs from January 1st to December 31st. The income tax is calculated based on your total annual income, which includes income from employment, self-employment, investments, and other sources. It’s important to note that Germany also has a solidarity surcharge and a church tax, which are additional taxes levied on top of the income tax.

To determine your tax liability, you need to consider various factors such as your marital status, number of dependent children, and any applicable deductions or exemptions. Now, let’s explore the different tax brackets and how they are structured in Germany.

Germany uses a progressive tax system, which means that the tax rate increases as your income rises. The tax brackets are divided into several tiers, each with its own income range and corresponding tax rate. Let’s take a closer look at the different tax brackets in Germany:

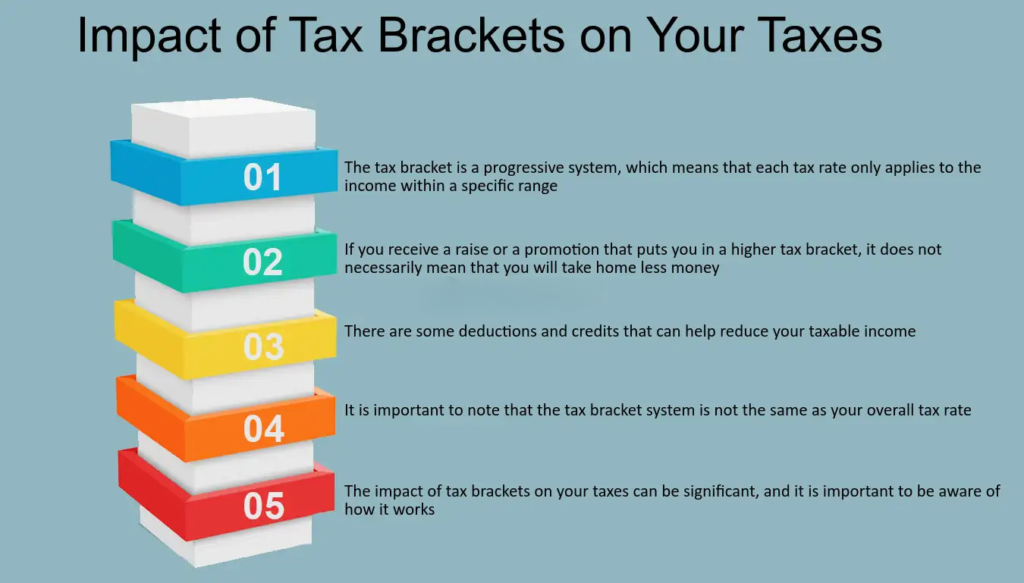

Understanding how tax brackets work is crucial for calculating your tax liability accurately. Many people mistakenly believe that moving into a higher tax bracket means they will pay a higher tax rate on their entire income. However, this is not the case.

In Germany, the progressive tax system means that only the income within each tax bracket is subject to the corresponding tax rate. For example, if you fall into the 14% tax bracket, only the income within that bracket will be taxed at 14%. The remaining income will be taxed at the applicable rate for the subsequent tax brackets.

This progressive tax system ensures that individuals with lower incomes pay a lower overall tax rate, while those with higher incomes contribute more to the tax revenue. It’s important to note that the tax rates mentioned here are subject to change, so it’s always advisable to consult the latest tax regulations or seek professional advice.

Now that we have a better understanding of the tax brackets in Germany, let’s explore some considerations for tax planning and optimization. By strategically managing your income and deductions, you can potentially reduce your tax liability and optimize your financial situation.

Optimizing your tax planning can have a significant impact on your financial situation. By taking advantage of available deductions and exemptions, strategically planning your income, and seeking professional advice, you can minimize your tax liability and make the most of your financial resources.

In addition to the progressive tax brackets, Germany’s tax system allows for various deductions and exemptions that can further reduce your taxable income. Let’s take a closer look at some of the most common deductions and exemptions available in Germany:

It’s important to note that the eligibility and specific rules for deductions and exemptions may vary depending on your individual circumstances. Make sure to consult the latest tax regulations or seek professional advice to determine which deductions and exemptions you qualify for.

Tax laws and regulations are subject to change, and it’s crucial to stay updated on any recent developments that may impact your tax liability. Here are some recent changes in tax brackets and their implications in Germany:

Being aware of recent changes in tax brackets and understanding their implications is essential for accurate tax planning and compliance. Regularly review tax updates and consult a tax professional to ensure you are taking advantage of any new opportunities or relief measures.

There are several common misconceptions about tax brackets in Germany that can lead to confusion. Let’s address some of these misconceptions to ensure a clear understanding of how tax brackets work:

By dispelling these misconceptions, you can have a clearer understanding of how tax brackets work and make informed financial decisions.

Navigating the German tax system can be challenging, especially for expats or individuals with complex financial situations. To ensure accurate tax planning and compliance, it’s highly recommended to seek professional advice from a tax advisor or accountant who specializes in German tax law.

A tax professional can provide personalized guidance based on your specific circumstances, help you optimize your tax position, and ensure compliance with all applicable tax regulations. They can also keep you informed about any recent changes in tax laws and help you take advantage of available deductions, exemptions, and relief measures.

Remember, accurate tax planning and compliance are essential for your financial well-being and peace of mind. By consulting a tax professional, you can navigate the complexities of the German tax system with confidence.

Understanding the different tax brackets in Germany is crucial for calculating your tax liability accurately and making informed financial decisions. By familiarizing yourself with the progressive tax system, you can optimize your tax planning, take advantage of available deductions and exemptions, and ensure compliance with all applicable tax regulations.

Remember to stay updated on any recent changes in tax laws and seek professional advice to navigate the intricacies of the German tax system. A tax advisor or accountant can provide personalized guidance based on your individual circumstances and help you make the most of your financial resources.

By taking control of your tax planning and compliance, you can minimize your tax liability, optimize your financial situation, and enjoy peace of mind knowing that you are on the right track.

The information provided in this article is for general informational purposes only. It is not intended as legal, tax, or financial advice. For specific advice regarding your individual circumstances, please consult a qualified professional.

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!