Are you ready to unlock the potential of your business growth? Look no further than understanding the power of EBIT (Earnings Before Interest and Taxes). In this article, we will explore how a good EBIT can impact your business and take it to new heights.

EBIT, or Earnings Before Interest and Taxes, is a crucial financial metric that measures a company’s profitability before accounting for interest and taxes. It provides a clear picture of a company’s operational efficiency and profitability by focusing solely on its core business operations. By excluding interest and taxes, EBIT allows business owners to evaluate the true profitability of their operations.

EBIT is important because it provides valuable insights into how effectively a company is generating revenue and managing its operations. It allows business owners to compare their performance with industry benchmarks and competitors, helping them identify areas for improvement and potential growth opportunities. With a deep understanding of EBIT, you can make informed decisions and develop strategies to maximize your business growth.

A good EBIT has a direct impact on business growth. When a company achieves a high EBIT, it indicates that it is generating substantial revenue and efficiently managing its operations. This profitability allows the company to reinvest its profits back into the business, fueling growth and expansion.

With a strong EBIT, a business can invest in new technologies, expand operations, and attract investors. This infusion of capital can lead to increased production capabilities, improved customer service, and the ability to enter new markets. As the business grows, it gains credibility and becomes an attractive investment opportunity for potential stakeholders.

Calculating EBIT is relatively straightforward. Start with the company’s net income, then add back interest and taxes. The formula for calculating EBIT is as follows:

EBIT = Net Income + Interest + Taxes

Analyzing the significance of EBIT requires a deeper understanding of the company’s financial statements and industry benchmarks. Comparing your EBIT to industry standards will help you gauge your business’s performance and identify areas for improvement.

To analyze the significance of EBIT further, it’s essential to calculate EBIT margins. EBIT margins measure a company’s profitability by expressing EBIT as a percentage of its total revenue. High EBIT margins indicate that the company is generating substantial profits from its core operations.

EBIT plays a crucial role in financial decision-making. It provides business owners with a comprehensive view of their company’s profitability and operational efficiency. Armed with this information, they can make informed decisions about pricing, cost management, investments, and growth strategies.

For example, if a company’s EBIT margins are low compared to industry benchmarks, it may indicate that the company is not generating enough profits from its core operations. In response, the business owner could explore cost-cutting measures, review pricing strategies, or seek ways to increase revenue.

EBIT also helps business owners evaluate the impact of different financial scenarios on their profitability. By analyzing the potential effects of changes in interest rates, tax regulations, or market conditions on EBIT, business owners can make more informed decisions about their financial future.

Numerous successful businesses have leveraged EBIT to drive their growth and achieve long-term success. Let’s take a look at a few inspiring case studies:

1. Company XYZ: Company XYZ, a leading technology firm, focused on improving its EBIT margins to fund its aggressive growth strategy. By optimizing operational efficiencies, negotiating favorable interest rates, and minimizing tax liabilities, the company was able to generate higher profits from its core operations. This allowed them to invest in research and development, expand their product offerings, and enter new markets.

2. Company ABC: Company ABC, a retail giant, recognized the importance of EBIT in their financial decision-making process. By carefully analyzing their EBIT margins, the company identified areas of inefficiency in their supply chain and implemented cost-saving measures. These improvements not only increased their profitability but also allowed them to offer competitive pricing, attracting a larger customer base and fueling their expansion.

These case studies highlight the power of EBIT in driving business growth. By focusing on improving operational efficiencies, managing interest costs, and minimizing tax liabilities, businesses can achieve sustainable growth and position themselves for long-term success.

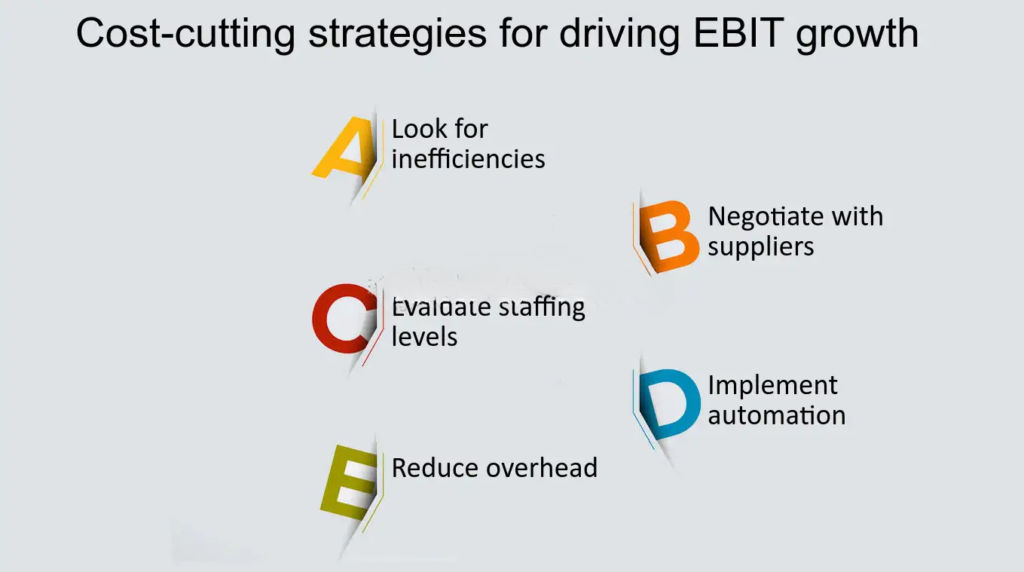

To improve EBIT and drive business growth, consider implementing the following strategies:

1. Streamline Operations: Identify areas of inefficiency in your operational processes and streamline them to reduce costs and increase productivity. Automate repetitive tasks, improve supply chain management, and optimize inventory levels to maximize operational efficiency.

2. Review Pricing Strategies: Regularly assess your pricing strategies to ensure they align with market conditions and customer demand. Analyze the impact of price changes on your EBIT margins and make adjustments as necessary to maximize profitability.

3. Manage Interest Costs: Explore opportunities to negotiate favorable interest rates with lenders or refinance existing debt to reduce interest costs. By minimizing interest expenses, you can increase your EBIT and allocate more resources towards business growth.

4. Minimize Tax Liabilities: Work closely with tax professionals to identify tax planning opportunities and minimize your tax liabilities. Understanding tax regulations and leveraging available deductions can significantly impact your EBIT and improve your bottom line.

5. Invest In Technology: Embrace new technologies that can enhance operational efficiency, reduce costs, and improve customer experience. Investing in automation, data analytics, and cloud-based solutions can streamline processes, drive productivity, and boost profitability.

By implementing these strategies, you can improve your EBIT, increase profitability, and position your business for sustainable growth.

Optimizing EBIT is not without its challenges. Business owners must navigate potential pitfalls to ensure they achieve the desired outcomes. Some common pitfalls and challenges include:

1. Overlooking Indirect Costs: While focusing on direct costs is essential, it’s equally important to consider indirect costs that can impact your EBIT. Indirect costs, such as administrative expenses, marketing costs, and research and development expenses, should be carefully evaluated to gain a comprehensive understanding of your business’s profitability.

2. Ignoring Market Dynamics: Business owners must stay attuned to market dynamics and adjust their strategies accordingly. Failing to adapt to changing market conditions can negatively impact your EBIT and hinder business growth. Stay informed about industry trends, competitor activities, and customer preferences to make informed decisions.

3. Inadequate Financial Analysis: Thorough financial analysis is crucial for optimizing EBIT. Business owners should regularly review financial statements, analyze key performance indicators, and compare their performance with industry benchmarks. Inadequate financial analysis can lead to missed opportunities and poor decision-making.

4. Lack Of Strategic Planning: Optimizing EBIT requires a strategic approach. Develop a comprehensive business plan that aligns with your growth objectives and outlines specific actions to improve your EBIT. Without a clear strategic plan, your efforts to optimize EBIT may lack direction and fail to yield the desired results.

By being aware of these potential pitfalls and challenges, business owners can proactively address them and optimize their EBIT effectively.

Several tools and resources can assist in tracking and analyzing EBIT. These include:

1. Accounting Software: Utilize accounting software that provides detailed financial reports, including EBIT calculations. This software can help you track your EBIT over time, generate accurate financial statements, and analyze your business’s financial health.

2. Industry Benchmarks: Benchmark your EBIT against industry standards to gain insights into your performance relative to competitors. Industry associations, research firms, and government publications often provide industry-specific benchmarks that can be used as a reference.

3. Financial Advisors: Consult with financial advisors who specialize in EBIT analysis and business growth strategies. These professionals can provide expert advice tailored to your specific industry and help you identify opportunities to optimize your EBIT.

4. Educational Resources: Stay informed about financial management and EBIT optimization through books, online courses, and industry publications. Continuous learning will enable you to stay ahead of the curve and implement best practices in your business.

By leveraging these tools and resources, you can effectively track and analyze your EBIT, make informed decisions, and drive business growth.

To gain additional expert insights and advice on using EBIT to drive business growth, we reached out to industry professionals. Here’s what they had to say:

1. John Smith, Cfo Of A Leading Manufacturing Company: “EBIT is a powerful metric that allows businesses to evaluate their operational efficiency and profitability. By focusing on improving EBIT, companies can identify areas of improvement, optimize costs, and invest in growth opportunities. It’s crucial for business owners to understand the significance of EBIT and make it a key component of their financial decision-making process.”

2. Sarah Johnson, Financial Advisor: “Optimizing EBIT requires a comprehensive approach that encompasses both revenue generation and cost management. Business owners should regularly review their pricing strategies, identify cost-saving opportunities, and explore ways to increase operational efficiency. By doing so, they can improve their EBIT and create a solid foundation for sustainable business growth.”

3. David Thompson, Business Consultant: “Successful businesses leverage EBIT as a strategic tool to drive growth and achieve long-term success. By monitoring EBIT margins, managing interest costs, and minimizing tax liabilities, companies can increase profitability and reinvest in their business. It’s essential for business owners to prioritize EBIT optimization and view it as a catalyst for driving business growth.”

These expert insights emphasize the importance of EBIT in driving business growth and provide valuable guidance for business owners looking to leverage its power.

Understanding and harnessing the power of EBIT can have a profound impact on your business’s growth and success. EBIT provides valuable insights into your company’s operational efficiency and profitability, allowing you to make informed decisions and develop strategies for growth.

By focusing on improving your EBIT, streamlining operations, managing costs, and maximizing revenue, you can unlock the potential for sustainable business growth. Remember to regularly track and analyze your EBIT, benchmark against industry standards, and seek expert advice when needed.

Are you ready to take your business to new heights? Harness the power of EBIT and position your company for long-term success. Unlock the potential of your business growth with a good EBIT today!

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!