Discover the insider tips and tricks to legally reduce your tax burden in Germany. We all know that taxes can be a significant expense, but with the right strategies and knowledge, you can minimize your tax liability and keep more money in your pocket. In this comprehensive guide, we will uncover the secrets to navigating the German tax system and maximizing your deductions.

Germany has a complex tax system, with numerous deductions and allowances available to taxpayers. By understanding the intricacies of the system, you can take advantage of every opportunity to reduce your tax bill. Whether you are a self-employed professional, a business owner, or an employee, there are specific strategies tailored to your individual circumstances.

Throughout this article, we will explore various legal ways to lower your tax liability, such as optimizing your business structure, leveraging tax credits and allowances, and making smart investment decisions. We will also provide practical advice on working with tax professionals and keeping meticulous records to ensure compliance with German tax regulations.

Don’t let taxes eat into your hard-earned income. Take control of your finances and start legally minimizing your tax liability in Germany today.

Germany offers a wide range of deductions and exemptions that can help individuals reduce their tax liability. Understanding these tax breaks is crucial for maximizing your savings. Some common deductions and exemptions in Germany include:

Personal Deductions: Germany allows individuals to deduct certain personal expenses from their taxable income. These may include expenses related to education, healthcare, and housing.

Child-Related Deductions: If you have children, you may be eligible for various deductions, such as child allowances, childcare expenses, and education-related expenses.

Employment-Related Deductions: If you are an employee, you may be able to deduct expenses related to your job, such as travel expenses, work-related training, and professional memberships.

Retirement Savings Deductions: Germany encourages individuals to save for retirement by offering tax incentives for contributions to retirement accounts, such as the Riester or Rürup pensions.

Homeownership Deductions: If you own a home, you may be eligible for deductions related to mortgage interest, property taxes, and home improvement expenses.

By understanding and taking advantage of these deductions and exemptions, you can significantly reduce your taxable income and lower your tax liability in Germany.

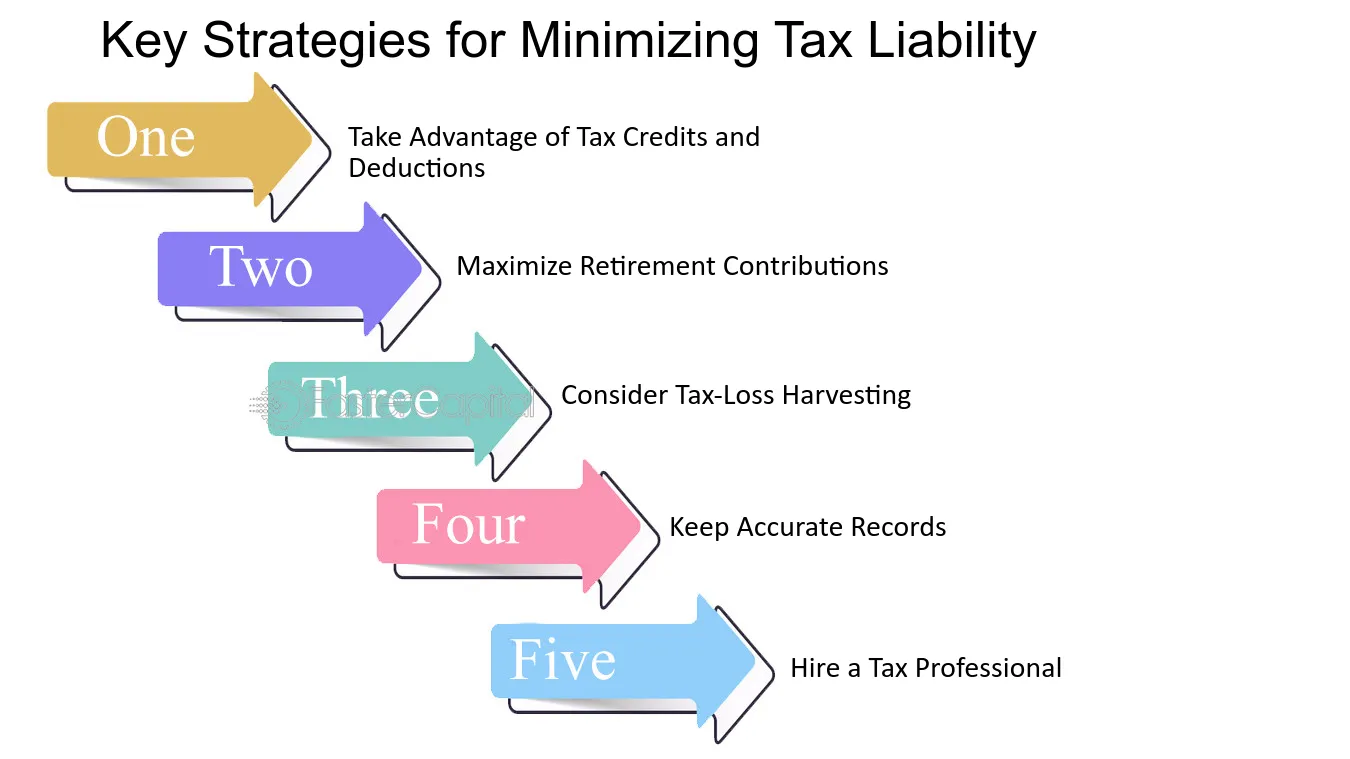

In addition to deductions and exemptions, there are several tax-saving strategies that individuals can employ to minimize their tax liability in Germany. Here are some common strategies to consider:

Splitting Income: If you are married or in a civil partnership, you can choose to have your income taxed jointly or separately. By analyzing your individual tax situations, you can determine which option will result in a lower overall tax liability.

Timing Of Income And Expenses: Timing is crucial when it comes to taxes. By strategically timing your income and expenses, you can potentially lower your tax liability. For example, if you expect to be in a lower tax bracket next year, you may want to defer income to the following year.

Maximizing Retirement Contributions: Contributing to retirement accounts not only helps you save for the future but can also lower your tax liability. Take advantage of the tax benefits offered by retirement accounts, such as tax-free growth or tax deductions for contributions.

Donating To Charities: Donations to registered charities in Germany are tax-deductible. By giving to a charitable cause, you can not only make a positive impact but also reduce your taxable income.

Utilizing Tax Credits And Allowances: Germany offers various tax credits and allowances, such as the basic allowance, childcare allowance, and education allowance. Make sure to explore all the available options to maximize your savings.

By implementing these strategies, you can legally minimize your tax liability and keep more of your hard-earned money.

If you are a business owner in Germany, there are additional tax deductions and strategies available to help you lower your tax liability. Here are some key considerations for maximizing deductions:

Choosing The Right Business Structure: The business structure you choose can have a significant impact on your tax liability. Consult with a tax professional to determine the most tax-efficient structure for your business, whether it’s a sole proprietorship, partnership, limited liability company (GmbH), or others.

Deducting Business Expenses: As a business owner, you can deduct various expenses related to your business operations, such as rent, utilities, office supplies, and professional services. Keep meticulous records and ensure that all expenses are legitimate and directly related to your business.

Capitalizing On Depreciation: Depreciation allows you to deduct the cost of assets over their useful life. Take advantage of depreciation rules to deduct the cost of business equipment, vehicles, and other assets.

Utilizing Research And Development (R&D) Tax Incentives: If your business is engaged in research and development activities, you may be eligible for R&D tax incentives, such as tax credits or accelerated depreciation.

Hiring Apprentices: By hiring apprentices, you can benefit from tax incentives and deductions. The German government offers financial support to businesses that provide training opportunities for apprentices.

Working closely with a tax consultant or accountant who specializes in business taxes can help you identify additional opportunities for tax savings and ensure compliance with German tax laws.

Investments can also offer tax advantages in Germany. By making smart investment decisions, you can potentially reduce your tax liability. Here are some investment-related tax incentives to consider:

Capital Gains Tax Exemptions: Under certain conditions, capital gains from the sale of shares or other investment assets may be tax-exempt in Germany. Consult with a tax professional to determine if you qualify for these exemptions.

Tax-Advantaged Investment Accounts: Germany offers tax-advantaged investment accounts, such as the Investment Savings Account (Investmentsteuerreformgesetz). These accounts provide tax benefits, such as reduced tax rates or tax exemptions on investment income.

Utilizing Tax-Efficient Investment Vehicles: Certain investment vehicles, such as investment funds or pension schemes, offer tax advantages. Explore the different investment options available and consider their tax implications.

Offset Investment Losses: If you experience investment losses, you can offset them against capital gains to reduce your overall tax liability. Carefully track your investment performance and consult with a tax professional to ensure you maximize this tax-saving opportunity.

By understanding the tax implications of your investments and making informed choices, you can optimize the tax benefits and minimize your tax liability.

Proper tax planning and record-keeping are essential for minimizing your tax liability in Germany. Here are some tips to help you stay organized and compliant:

Keep Meticulous Records: Maintain detailed records of your income, expenses, and deductions. This includes invoices, receipts, bank statements, and any other relevant financial documents. Accurate record-keeping will help you claim all eligible deductions and avoid potential audit issues.

Plan Ahead: Stay proactive by planning your tax strategy in advance. Consider consulting with a tax professional to ensure you are taking advantage of all available tax-saving opportunities.

Stay Informed: German tax laws and regulations can change frequently. Stay up-to-date with the latest developments by regularly reviewing official tax publications and seeking advice from reputable sources.

Use Tax Software Or Professionals: Consider using tax software or hiring a tax professional to help you navigate the complexities of the German tax system. They can assist with tax preparation, identify potential deductions, and ensure compliance with all necessary regulations.

By investing time and effort into proper tax planning and record-keeping, you can optimize your tax savings and minimize the risk of errors or penalties.

Navigating the German tax system can be complex, especially for individuals and businesses with unique circumstances. Hiring a tax consultant or accountant can provide valuable expertise and guidance. Here are some considerations when choosing a tax professional in Germany:

Qualifications And Experience: Look for a tax consultant or accountant who is qualified and experienced in German tax regulations. Check their credentials, certifications, and track record.

Specialization: Ensure that the tax professional has experience working with clients in similar situations to yours. This could include individuals, business owners, expatriates, or international investors.

Communication And Responsiveness: Effective communication is key when working with a tax professional. Choose someone who is responsive to your inquiries and provides clear explanations of complex tax matters.

Trust And Confidentiality: Tax matters involve sensitive financial information. Select a tax professional who adheres to high ethical standards and values client confidentiality.

Cost And Value: Consider the fees charged by the tax professional and weigh them against the value they can provide. Look for a balance between cost and expertise.

A qualified tax professional can help you navigate the complexities of the German tax system, identify tax-saving opportunities, and ensure compliance with all legal requirements.

Staying informed about German tax laws and regulations is crucial for minimizing your tax liability. Here are some resources that can help you stay up-to-date:

Federal Ministry Of Finance (Bundesministerium Der Finanzen): The official website of the Federal Ministry of Finance provides information on tax laws, regulations, and updates.

Tax Advisors’ Associations: Various tax advisors’ associations in Germany provide resources and publications to help individuals and businesses navigate the tax system. Examples include the German Association of Tax Advisors (Deutscher Steuerberaterverband) and the Chamber of Tax Consultants (Steuerberaterkammer).

Tax Publications: Subscribe to reputable tax publications, both online and offline, that provide insights, analysis, and updates on German tax laws and regulations. Examples include tax magazines, journals, and newsletters.

Online Forums And Communities: Participate in online forums or communities where individuals discuss German tax matters. Engaging with fellow taxpayers and professionals can provide valuable insights and tips.

Tax Professional Networks: Connect with tax professionals who specialize in German tax matters. They can provide guidance, answer questions, and keep you informed about important changes in the tax landscape.

By actively seeking out and utilizing these resources, you can stay informed and ensure that you are taking advantage of all available tax-saving opportunities.

To illustrate the practical application of tax-saving strategies in Germany, let’s explore a few real-life case studies:

Self-Employed Professional: Anna is a freelance graphic designer in Germany. She takes advantage of various tax deductions, such as home office expenses, professional development courses, and business-related travel. By keeping meticulous records and working with a tax consultant, Anna maximizes her deductions and significantly reduces her tax liability.

Small Business Owner: Markus owns a small bakery in Germany. He utilizes the tax benefits of hiring apprentices and takes advantage of business expense deductions, such as ingredients, equipment, and marketing costs. By properly structuring his business and working closely with an accountant, Markus minimizes his tax liability and reinvests the savings back into his business.

Investor: Lisa is an investor in Germany. She strategically manages her investment portfolio to minimize capital gains taxes. By offsetting investment losses against capital gains, Lisa effectively reduces her taxable income and maximizes her tax savings.

These case studies highlight the importance of understanding the specific tax regulations applicable to your situation and leveraging the available tax-saving opportunities.

Minimizing your tax liability in Germany is not only legal but also essential for keeping more of your hard-earned money. By understanding the intricacies of the German tax system, utilizing deductions and exemptions, implementing tax-saving strategies, and working with tax professionals, you can optimize your savings and ensure compliance with all legal requirements.

Take control of your finances and start exploring the various ways to legally minimize your tax liability in Germany. With proper planning, record-keeping, and a proactive approach, you can navigate the German tax landscape with confidence and keep more money in your pocket.

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!