Congratulations on taking this exciting step towards entrepreneurship! Germany is renowned for its strong economy, highly skilled workforce, and favorable business climate. However, successfully establishing a business in Germany requires careful planning and consideration of the key steps and requirements involved. In this article, we will guide you through the essential aspects of starting a business in Germany.

Germany has a well-defined legal framework that governs the establishment and operation of businesses. Before you jump into the process, it’s crucial to understand the legal requirements involved. One of the first decisions you’ll need to make is selecting the appropriate legal structure for your business. There are several options available, including sole proprietorship, partnership, limited liability company (GmbH), and stock corporation (AG). Each structure has its own advantages and disadvantages, so it’s essential to carefully evaluate which one best suits your business goals and needs.

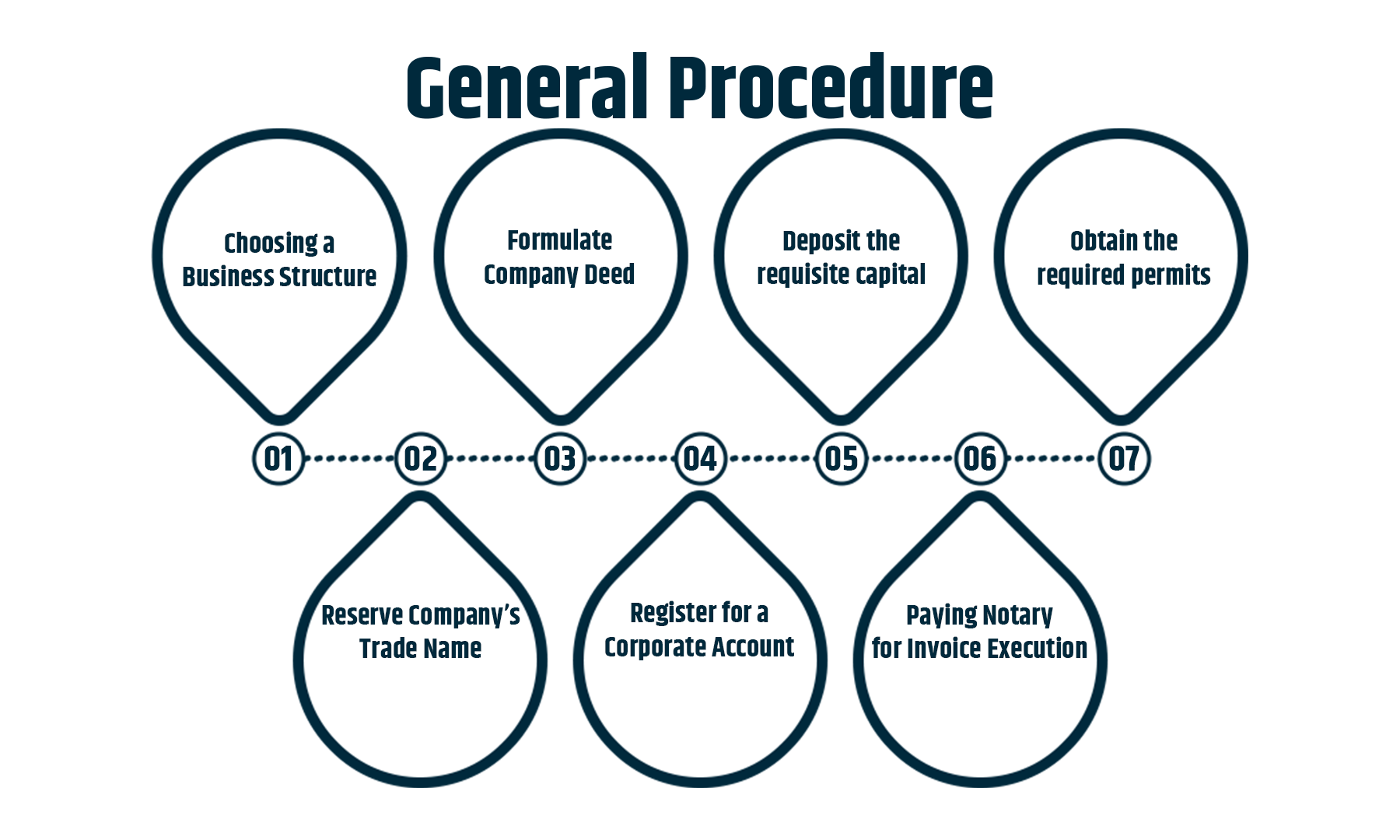

Once you have decided on the legal structure, the next step is to register your business with the relevant authorities. The registration process involves submitting various documents, such as proof of identity, business plan, and company statutes. It’s important to note that different legal structures have different registration requirements, so it’s advisable to seek professional guidance or consult with a lawyer to ensure compliance with all legal obligations.

In addition to the registration process, you may also need to obtain a trade license (Gewerbeschein) depending on the nature of your business. Certain professions, such as healthcare, finance, and legal services, may require additional certifications or qualifications. It’s crucial to research and understand the specific industry regulations and requirements that apply to your business to avoid any potential legal issues in the future.

As a business owner in Germany, you will be subject to various tax obligations. Understanding and complying with these obligations is essential for the smooth operation of your business. The main types of taxes that businesses in Germany are typically required to pay include corporate income tax (Körperschaftsteuer), trade tax (Gewerbesteuer), and value-added tax (Umsatzsteuer).

Corporate income tax is levied on the profits generated by your business. The tax rate is currently set at 15% for profits up to €1 million and 29.9% for profits exceeding that threshold. Trade tax, on the other hand, is a municipal tax that is imposed on the income generated by commercial activities. The trade tax rate can vary depending on the location of your business, as it is determined by the respective municipality.

Value-added tax is a consumption tax that is charged on goods and services. The standard VAT rate in Germany is 19%, but there are reduced rates for certain goods and services. It’s important to keep accurate records of your business transactions and ensure timely filing and payment of taxes to avoid any penalties or legal consequences.

If your business requires employees, it’s essential to understand the employment regulations in Germany. The country has a strong labor market with robust employee protections. As an employer, you will need to comply with various laws and regulations, including those related to minimum wage, working hours, vacation entitlement, and social security contributions.

Germany also has a dual education system, which combines practical training in a company with theoretical education in vocational schools. This system provides a highly skilled workforce, but it also means that employers need to adhere to specific regulations when hiring and training apprentices.

When hiring employees, it’s important to have clear employment contracts that outline the terms and conditions of the employment relationship. It’s also advisable to familiarize yourself with the local customs and cultural norms surrounding the workplace to foster a positive and productive work environment.

Starting a business often requires a significant amount of capital. Fortunately, there are various financing options available for startups in Germany. One common source of funding is through banks and financial institutions, which offer loans and credit facilities tailored to the needs of small and medium-sized enterprises (SMEs).

In addition to traditional financing, Germany also has a robust startup ecosystem with numerous government programs and initiatives aimed at supporting entrepreneurs. These programs provide grants, subsidies, and other forms of financial assistance to startups, particularly in innovative and high-growth sectors.

Another financing option to consider is venture capital. Germany has a thriving venture capital market, with many investors actively seeking promising startups to invest in. Venture capital firms provide funding in exchange for equity, and they often bring valuable expertise and networks to help accelerate the growth of the business.

Depending on the nature of your business, you may need to obtain specific permits and licenses to operate legally in Germany. The requirements can vary significantly depending on the industry and location, so it’s crucial to research and understand the specific regulations that apply to your business.

Some common permits and licenses include trade licenses (Gewerbeschein), health and safety certificates, environmental permits, and food handling licenses. If you are planning to import or export goods, you will also need to comply with customs regulations and obtain the necessary licenses and certifications.

Navigating the permit and licensing process can be complex, especially for foreign entrepreneurs. It’s advisable to seek guidance from industry-specific associations, chambers of commerce, or consult with a local lawyer who specializes in business law to ensure compliance with all regulatory requirements.

Understanding the cultural and business etiquette in Germany is crucial for building strong relationships and successfully conducting business in the country. Germans value punctuality, professionalism, and efficiency. It’s important to be well-prepared for meetings and presentations, and to respect the hierarchical structure within organizations.

Business communication in Germany is typically formal and direct. It’s important to be clear and concise in your communication, and to use a professional tone. Germans also appreciate thoroughness and attention to detail, so it’s important to provide comprehensive and well-researched proposals and reports.

Building trust and establishing personal connections is also important in German business culture. Networking events, trade fairs, and industry conferences provide valuable opportunities to connect with potential business partners and customers. It’s advisable to invest time in building relationships and maintaining regular contact to foster long-term business partnerships.

Setting up a business in Germany requires careful planning and consideration of the key steps and requirements involved. From understanding the legal structure options and registration process to obtaining the necessary permits and licenses, and navigating the tax and employment regulations, there are several factors to consider.

By following the guidelines outlined in this article and seeking professional advice when necessary, you can navigate the process with confidence and establish a successful business in Germany. Remember to conduct thorough research, develop a solid business plan, and build strong relationships with local partners and stakeholders.

Germany offers a wealth of opportunities for entrepreneurs, and with the right knowledge and preparation, you can seize these opportunities and thrive in the German market. So, take the plunge, and embark on this exciting journey of entrepreneurship in Germany!

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!