Did you know that a traditional office space in Munich costs an average of €23.50 per square meter? That’s roughly €2,350 monthly for a modest 100-square-meter office!

But here’s the good news – a virtual office in Germany offers you the same professional presence at a fraction of the cost. You get a prestigious business address, mail handling, and all the perks of a physical office without the astronomical rent.

Setting up a virtual office requires careful attention to legal requirements. You’ll need proper statutory address documentation in Germany and local address verification to stay compliant with German business laws. That’s where House of Companies steps in – we handle all these complexities while you focus on growing your business.

Ready to establish your business presence in Germany without breaking the bank? Let’s explore how to set up and maintain a fully compliant virtual office.

Setting up your virtual office in Germany requires careful attention to legal compliance. House of Companies ensures you meet all requirements while maintaining a professional business presence.

Your virtual office must be more than just a mailbox – it needs to be a real, tangible address where your business can receive official communications. The German Commercial Register (Handelsregister) requires:

House of Companies provides all these elements, ensuring your virtual office meets federal requirements while maintaining your professional image.

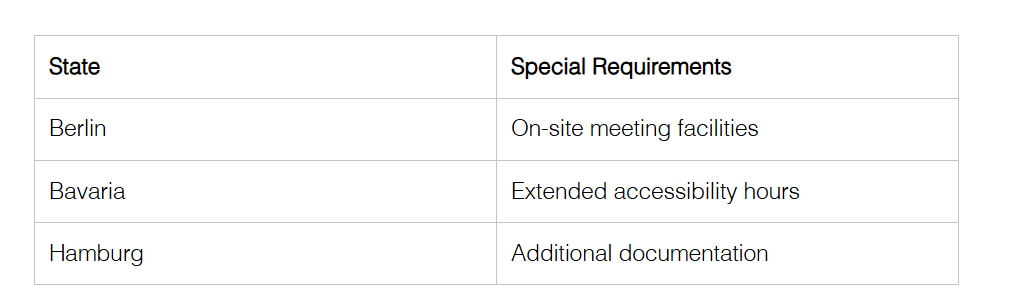

Different German states have varying requirements for virtual offices. Here’s what you need to know about key business regions:

Our eBranch service adapts to these regional variations, ensuring your virtual office complies with local regulations while maximizing your business potential.

Tax Office Guidelines

The German tax office (Finanzamt) has strict requirements for virtual offices. Your address must ensure:

Accessibility: The tax office needs to reach you reliably for official communications. House of Companies provides immediate notification of important tax documents.

Documentation: You’ll need an office service agreement proving your virtual office is used for genuine business purposes. We provide comprehensive documentation that satisfies tax authority requirements.

Audit Preparation: During tax audits, you must demonstrate that your virtual address serves as a legitimate business location. Our service includes audit-ready documentation and support.

Remember that using a virtual office address while working from another location requires special consideration. You must declare your actual place of business management in your tax registration questionnaire. House of Companies helps you maintain transparency with tax authorities while benefiting from a prestigious German business address.

Transform your business presence in Germany with the right documentation! House of Companies makes your virtual office setup smooth and hassle-free.

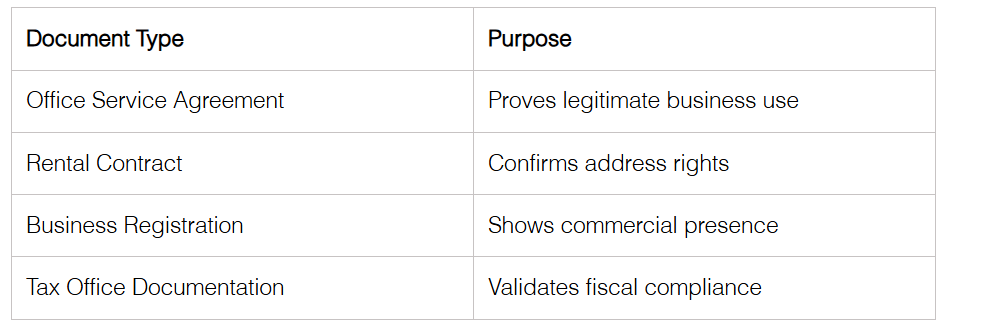

Your virtual office setup requires specific documentation to ensure full compliance with German regulations. Here’s what you need:

Essential Document Checklist:

House of Companies provides you with all necessary paperwork, perfectly prepared for immediate submission to German authorities.

Your identity verification must meet strict German standards. The process includes:

With House of Companies’ eBranch service, you’ll complete this process smoothly, ensuring your virtual office setup meets all legal requirements.

Proving your business location is crucial for your statutory address in Germany. You’ll need:

Primary Requirements:

– A valid office service agreement showing your right to use the address

– Proof that your virtual office can handle official communications

– Documentation showing the address is suitable for business activities

– Evidence of mail handling capabilities

House of Companies provides premium virtual office services that exceed standard requirements. Your address verification package includes comprehensive documentation that satisfies both commercial register and tax office demands.

Enhanced Verification Support:

We handle the complete verification process, including:

– Preparation of all necessary documentation

– Direct communication with authorities

– Regular updates to maintain compliance

– Ongoing support for address verification

Your virtual office in Germany becomes reality faster with House of Companies’ expert guidance through every documentation requirement. We ensure your statutory address meets all legal standards while maintaining the professional image your business deserves.

Get your virtual office in Germany running smoothly with perfect tax compliance! House of Companies makes your tax registration and compliance journey effortless and worry-free.

Your success starts with proper tax registration! Here’s how House of Companies streamlines your Finanzamt registration:

House of Companies’ eBranch service handles your entire registration process, ensuring your virtual office in Germany meets all tax authority requirements.

Make your statutory address in Germany work perfectly with our comprehensive compliance support. Your business needs:

Premium Support Package:

House of Companies offers complete monitoring of your compliance deadlines. Your local address in Germany stays fully compliant while you focus on business growth.

Protect your business with perfect document management! German tax law demands specific storage requirements (GoBD compliance):

Essential Storage Requirements:

– Digital documents need tamper-proof storage

– Business records require 10-year retention

– Immediate document retrieval capability

– Secure backup systems

House of Companies’ virtual offices services include state-of-the-art document management systems. Your business documents stay safe, compliant, and instantly accessible.

Enhanced Security Features:

– Advanced encryption protocols

– Regular compliance audits

– Automated backup systems

– Instant document retrieval

Take advantage of House of Companies’ premium eBranch service – your complete solution for tax compliance and document management in Germany. Our expert team handles all compliance requirements while you expand your business reach with a prestigious German business address.

Power up your business communications with cutting-edge mail handling systems! House of Companies brings you Germany’s most advanced mail management solutions for your virtual office.

Your business deserves premium mail handling! House of Companies transforms your physical mail management with:

Premium Mail Services:

– Professional mail receipt and sorting

– Secure storage facilities

– Express forwarding worldwide

– Personal pickup options

Choose between daily, weekly, or monthly forwarding schedules. Your mail reaches you exactly when and where you need it!

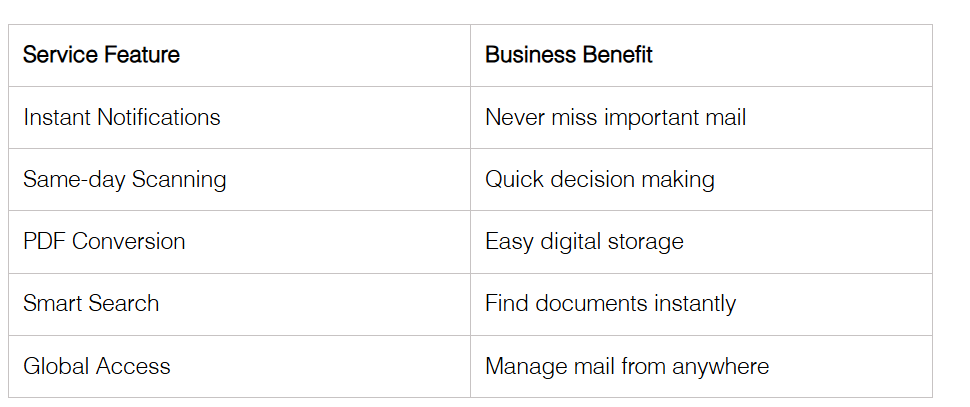

Step into the future with our revolutionary digital mail system! Here’s how House of Companies makes your mail management effortless:

Your virtual office in Germany becomes truly digital with our 256-bit SSL-encrypted servers. Access your business correspondence 24/7 through our secure online portal.

Protect your business communications with House of Companies’ military-grade security systems. Your statutory address in Germany comes with:

Enhanced Security Features:

Experience the perfect blend of German efficiency and digital innovation! Our eBranch service transforms your local address in Germany into a powerhouse of modern business communications.

Exclusive Benefits:

– Fire-proof and flood-proof document storage

– Instantaneous PDF delivery

– Searchable digital archives

– Professional mail forwarding worldwide

House of Companies delivers more than just mail handling – we provide a complete virtual offices service package. Your business gets a prestigious German address backed by state-of-the-art mail management systems.

Take control of your business communications today! Let House of Companies handle your mail while you focus on growing your business. With our premium mail management solutions, your virtual office in Germany operates as smoothly as a traditional office – but with greater flexibility and lower costs!

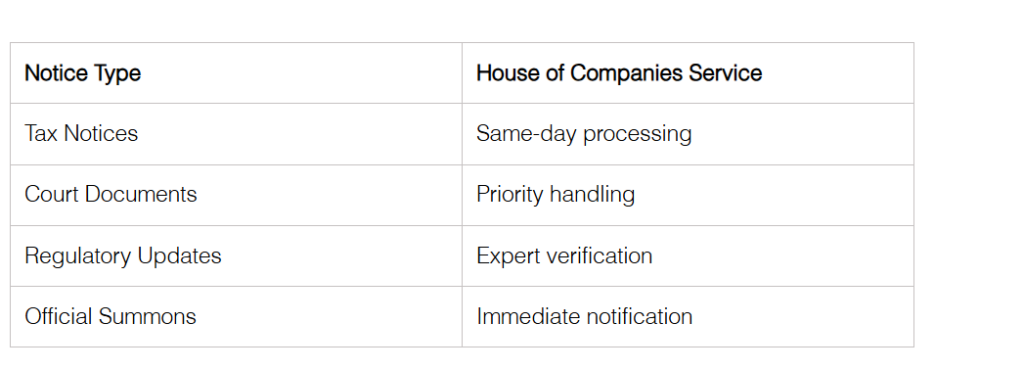

Make your German business presence count with flawless official communications! House of Companies delivers premium solutions for managing your government correspondence through your virtual office in Germany.

Your statutory address in Germany becomes a powerhouse of efficient communication with House of Companies’ premium handling service. Experience excellence with:

Premium Communication Features:

Our eBranch service transforms your local address in Germany into a complete communication hub. Your government correspondence receives VIP treatment with real-time processing and expert handling.

Boost your business compliance with House of Companies’ comprehensive legal notice management. Your virtual office in Germany includes:

Enhanced Protection Package:

– Certified document verification

– Legal compliance monitoring

– Automated notice tracking

– Secure digital archiving

House of Companies ensures your business never misses critical legal communications. Our virtual offices services include complete management of your statutory obligations.

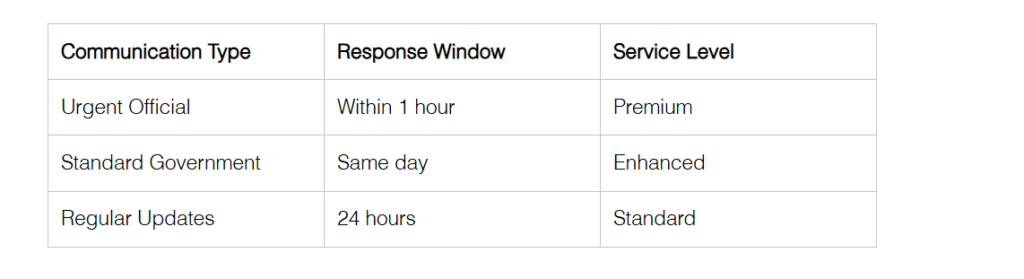

Excel in official communications with House of Companies’ lightning-fast response system. Your business deserves the best response times:

Priority Response Windows:

House of Companies sets industry-leading standards for communication management. Your virtual office operates with precision timing:

Experience the House of Companies difference with our comprehensive eBranch service package:

Premium Communication Benefits:

– Round-the-clock monitoring

– Multi-channel notifications

– Priority document processing

– Expert compliance support

Your business communications deserve German precision and efficiency. House of Companies delivers both through our advanced virtual office solutions. Take advantage of our industry-leading response times and comprehensive communication management services.

Transform your business presence with House of Companies’ premium virtual office solutions. Your statutory address in Germany becomes more than just a location – it’s your gateway to flawless official communications and complete compliance peace of mind.

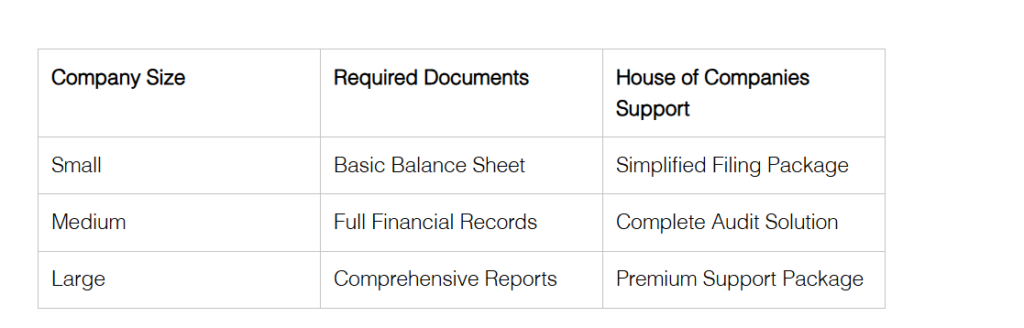

Boost your business success with perfect legal compliance! House of Companies delivers premium solutions to keep your virtual office in Germany running smoothly and legally.

Your virtual office needs constant audit readiness! House of Companies’ premium eBranch service ensures you’re always prepared with:

Complete Audit Package:

– Financial statements within three months of year-end

– Independent auditor verification support

– Management board documentation

– Shareholder approval records

House of Companies transforms your statutory address in Germany into an audit-ready business hub. Experience worry-free operations with our complete compliance support!

Stay ahead with House of Companies’ premium update management! Your virtual office in Germany receives continuous updates for:

Critical Updates Coverage:

Your local address in Germany becomes a center of excellence with our premium eBranch service. House of Companies handles all regulatory updates while you focus on business growth.

Premium Update Benefits:

– Instant notification of regulatory changes

– Expert guidance on implementation

– Complete documentation updates

– Compliance verification checks

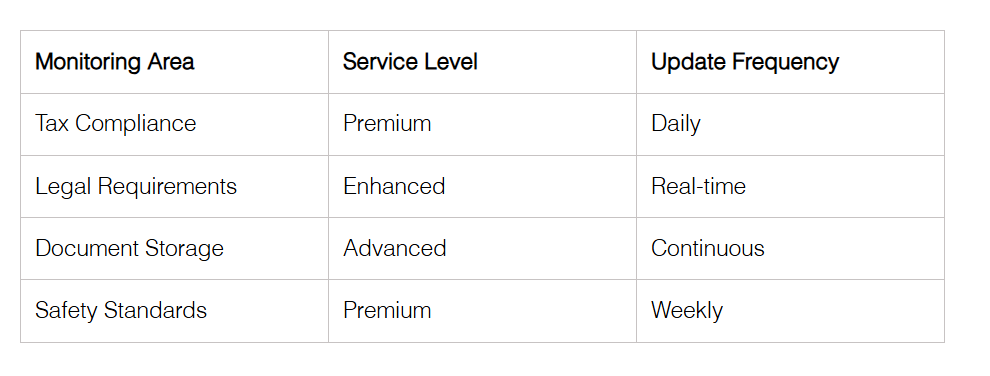

Transform your compliance management with House of Companies’ premium monitoring solutions! Your virtual office stays perfectly compliant with:

24/7 Compliance Watch:

– Real-time regulation tracking

– Continuous documentation updates

– Regular compliance assessments

– Instant alert system

Experience the House of Companies difference with our comprehensive compliance package:

Your business deserves perfect compliance! House of Companies delivers:

Premium Compliance Features:

– Electronic data management for tax audits

– Transparency Register updates

– Environmental impact assessments

– Workplace safety monitoring

House of Companies transforms your virtual offices services with:

– Expert compliance officers

– Regular risk assessments

– Proactive issue detection

– Continuous improvement programs

Your statutory address in Germany becomes more than just a location – it’s your gateway to perfect legal compliance! House of Companies handles:

Enhanced Protection Package:

– Regular compliance audits

– Documentation updates

– Risk management

– Authority communications

Experience German business excellence with House of Companies’ premium eBranch service. Your virtual office operates with:

– Perfect legal alignment

– Complete documentation

– Expert compliance support

– Regular updates

Take your business compliance to the next level! House of Companies delivers:

– Comprehensive audit support

– Real-time updates

– Expert monitoring

– Complete peace of mind

Your virtual office in Germany deserves premium compliance management. House of Companies transforms your business operations with:

– Perfect legal alignment

– Complete documentation

– Expert support

– Continuous monitoring

Setting up a virtual office in Germany offers significant advantages – from cost savings to professional business presence. Your virtual office needs proper documentation, tax compliance, efficient mail handling, and regular updates to stay fully compliant with German regulations.

House of Companies handles these complex requirements while you build your business. Our premium eBranch service ensures your virtual office meets all legal standards, from perfect tax documentation to secure mail management systems. You get a prestigious German business address without the high costs of traditional office space.

Remember that success with a virtual office depends on choosing the right service provider. House of Companies delivers German efficiency, complete legal compliance, and expert support – everything you need for a strong business presence in Germany.

To set up a virtual office in Germany, you need a physical location suitable for business activities, reliable mail handling systems, regular accessibility during business hours, company signage at the location, and proof of legitimate business operations. You must also comply with state-specific regulations and tax office guidelines.

Tax registration involves setting up an ELSTER account, applying for a tax number, and registering for VAT. Ongoing compliance requires submitting monthly VAT returns, preparing annual tax declarations, and submitting financial statements. It’s crucial to maintain proper document storage according to German tax law requirements.

Virtual offices in Germany can offer both physical and digital mail management solutions. Physical mail services include professional receipt, sorting, secure storage, and forwarding options. Digital solutions provide instant notifications, same-day scanning, PDF conversion, and secure online access to your business correspondence.

Virtual office providers can handle government correspondence, including tax notices, court documents, and regulatory updates. They typically offer immediate processing of official documents, expert verification, and priority handling of urgent matters. Many providers also ensure compliance with legal notice requirements and maintain quick response times for various types of communications.

Maintaining legal compliance for a virtual office in Germany involves regular audit preparations, staying updated with regulatory changes, and continuous compliance monitoring. This includes preparing financial statements, updating documentation as per new regulations, and conducting regular compliance assessments. It’s also important to have systems in place for tax compliance, legal requirement tracking, and document storage management.

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!